AI Banking-as-a-Service

Economy

Partners

using AI technology Select the best financing condition by having multiple

source of funds in competition

Credit Card Fraud Detection System

using Deep Learning

Reinforcement Learning Fairness

Improvement System

[시사매거진] 지난 2월 1일 싱가포르에서 아세안 10개국이 참여하는 제4차 아세안 디지털 장관 회의(ADGMIN)가 열렸다.디지털 장관 회의 주관으로 진행된 ‘2024 아세안 디지털 어워즈(ASEAN Digital Awards)’는 아세안 역내 디지털 환경 조성에 기.....

Apr. 08. 2024

에이젠글로벌(AIZEN Global)은 △유니콘 기업 ‘그랩(Grab)’에 금융서비스 공급, △홍콩 핀테크위크 솔루션 1위 △싱가포르 금융당국(MAS)이 선정한 책임감 있는 AI기업 △싱가포르 핀테크 어워드 글로벌 2위 선정 등 핀테크 해외 진출의 성공 기업 사례로 꼽.....

Apr. 08. 2024

핀테크산업협회와 협회 디지털경제금융연구원이 28일 은행회관에서 "2024년 플랫폼을 활용한 금융경쟁력 제고와 대응방안"을 주제로 세미나를 개최했다. 세미나는 협회 이근주 회장의 개회사와 금융위원회 권대영 사무처장의 축사로 막을 열었다. 권대영 금융위원회 사무처장은 “시.....

Apr. 08. 2024

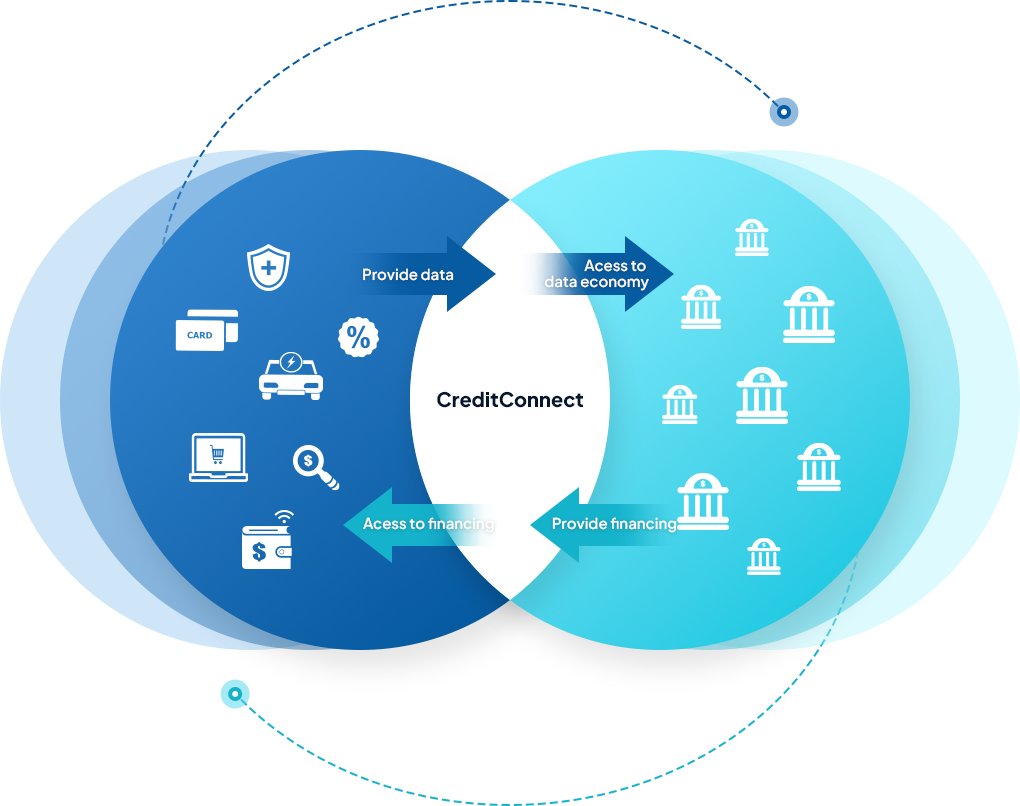

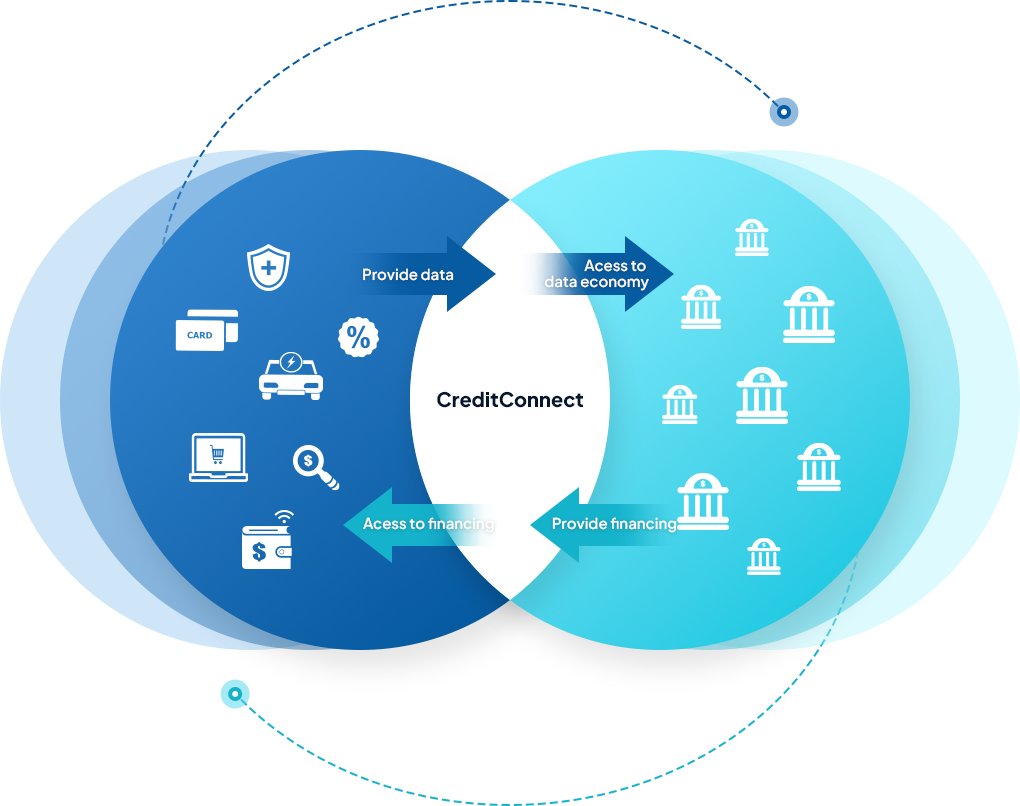

에이젠글로벌의 AI 뱅킹 서비스 ‘크레딧커넥트’ (사진=에이젠글로벌)인공지능(AI) 금융 B2B 전문 에이젠글로벌(대표 강정석)은 아시아 시장에 AI 뱅킹 서비스를 확대, 글로벌 핀테크로 도약하겠다고 15일 밝혔다.AI 기술의 확대와 함께 금융 분야도 새로운 데이터를.....

Jan. 19. 2024