AIZEN’s AI Lending Platform: CreditConnect

Feb. 23. 2021본문

AIZEN has launched the artificial intelligence (AI) lending platform “CreditConnect” to provide quick and easy lending services to e-commerce, health-care, insurance, education, and other data platform customers in Southeast Asia, starting in Vietnam last December. Based on the AI financial solution ABACUS, it quickly evaluates customers and applies the Credit Cycle Control Module to achieve a high approval rate and provide quick lending services while managing risk.

AI-Powered Platform Innovation: Financial Vertical AI and Data Ecosystem

Two elements of core competitiveness are required to apply AI to finance. The first element is the financial domain knowledge, a consideration of vertical AI. Methodologies to learn, decide correctly, improve efficiency, and save costs backed by financial expertise and experience are necessary, and these are integrated into CreditConnect. On the other hand, the second element is the data ecosystem for the AI platform. Another vital factor is its connection with financial institutions through data convergence of data platforms, allowing for data-based, automated decision-making among financial value chains and providing technology for combining different data and translating them into “Credit Data,” thereby extending to various financial services.

Advanced Financial Services through Platform Innovation

It is estimated that the autonomous driving of future vehicles will require thousands of semiconductor chips. In addition to the semiconductor and battery, a combination of different platforms, such as hardware, AI, data center, and content, is needed to complete the futuristic automation “platform.” The cars will be used not only for mere transportation but also for a platform war, where convergence and innovation occur. As such, the financial industry will experience advanced financial services based on new fiscal platforms. With the aforesaid financial benefits and data ecosystem, CreditConnect seeks to establish a foundation of “platform innovation” to connect financial institutions and data platforms. AI-powered fundamental credit creation and reduced operating costs will open advanced financial services to new customers, and credit services will be personalized, not customized, for financial companies.

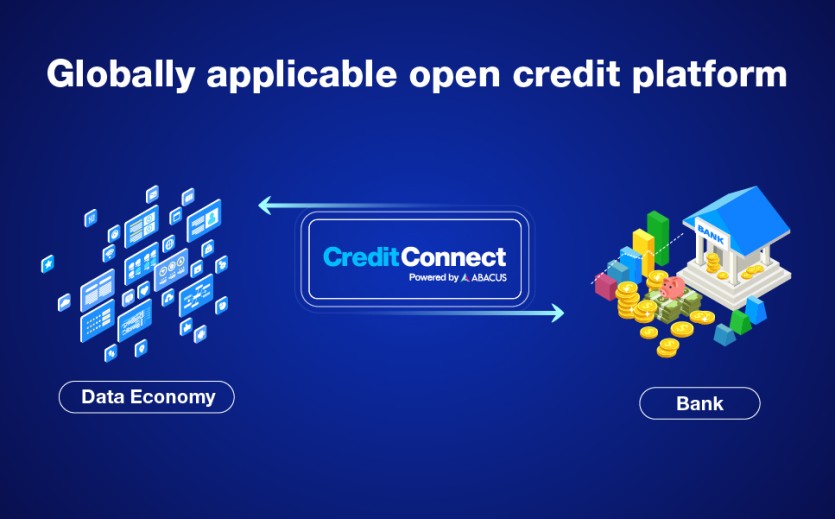

CreditConnect to Evolve as Globally Applicable Open Credit Platform

CreditConnect evolves as a global open credit platform, bridging the data economy and financial environment. In Vietnam, it offers the AIZEN-Virtual Credit Card service for e-commerce by converting e-commerce transaction information to credit data. Instead of offering basic credit, it will provide optimal and active credit services by understanding customers’ needs in advance. In particular, it will focus on ensuring a seamless connection between customers and finance through customer security and product diversification by linking with financial institutions seeking to offer credit.